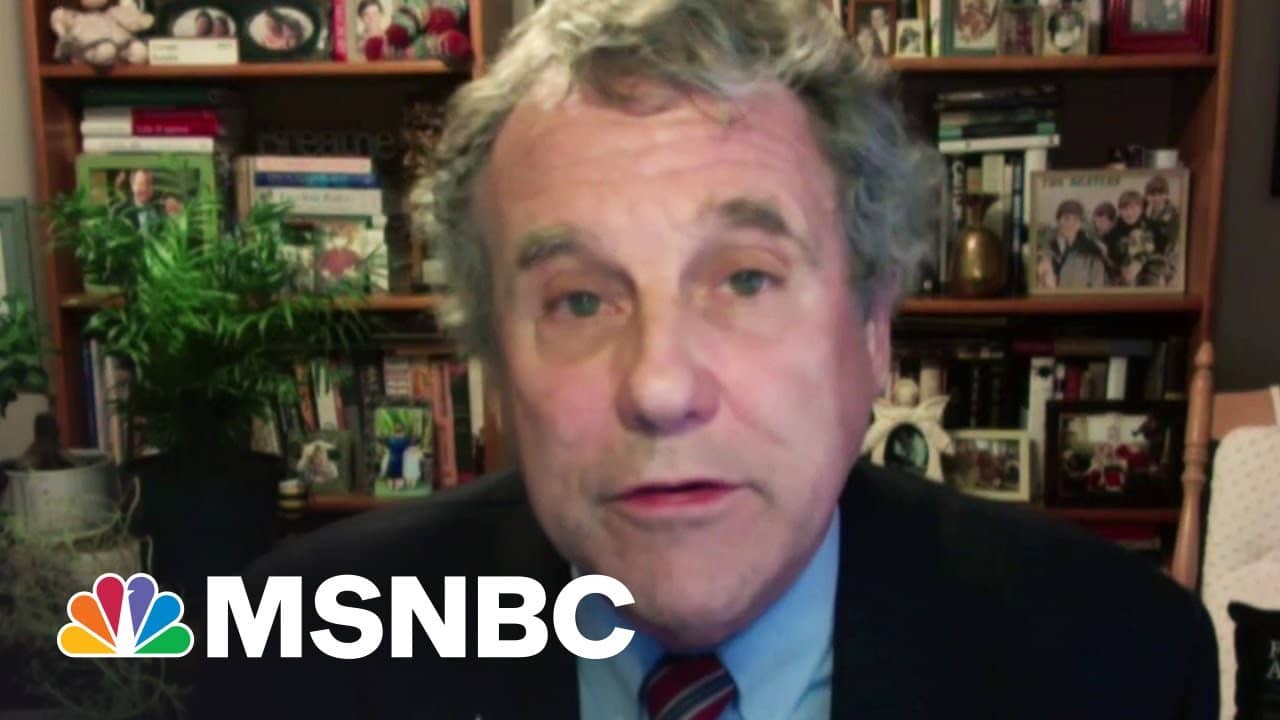

“It’s going to drop the poverty rate between 40 and 50 percent. Imagine that,” says Sen. Sherrod Brown, discussing the new government policy that will send most parents several hundred dollars per month, per child—no strings attached.

» Subscribe to MSNBC:

About All In with Chris Hayes:

Chris Hayes delivers the biggest news and political stories of the day with a commitment to in-depth reporting that consistently seeks to hold the nation's leaders accountable for their actions. Drawing from his background as a reporter, Hayes at times reports directly from the scene of a news event as it occurs to provide a firsthand account, digging deep and speaking with people who represent different points of view. Hayes brings the nation's officials, legislators, policymakers, and local activists to the table to address key issues affecting communities across America.

MSNBC delivers breaking news, in-depth analysis of politics headlines, as well as commentary and informed perspectives. Find video clips and segments from The Rachel Maddow Show, Morning Joe, Meet the Press Daily, The Beat with Ari Melber, Deadline: White House with Nicolle Wallace, Hardball, All In, Last Word, 11th Hour, and more.

Connect with MSNBC Online

Visit msnbc.com:

Subscribe to MSNBC Newsletter:

Find MSNBC on Facebook:

Follow MSNBC on Twitter:

Follow MSNBC on Instagram:

#MSNBC #ChildTaxCredit #PovertyRate

Let’s turn government into something that supports workers.

@StillLivinginthewoods .. What is the Gov taking away from you??.. What are you giving up??..

I am sure you didn’t waste anytime cashing those Stimulus Checks when they were handed out..

What did you give up, btw ?.. Had to give up something, huh, according to you..

Just typical Republikkkons beating up on Women, children and Parents. Yeeeah, that’s a good thing to do..

After all people like you want to control Women’s Reproductive Rights, right.. After all, Abortions and birth control are nothing but a political football to people like you..

But you get your free Viagra don’t you..

Like a 2 yr old repeating what your parents tell you..

@Danny H but it is meant to support big business and the rich right??

@MR GOODNESS no its not

@Danny H than why is it ok? because it happens everyday!!

@MR GOODNESS who said it happens everyday? Where are u getting this information? Are u talking about corporate bailouts? What are u talking about? Cause if you think giving money to the rich is bad cause they already have money but your ok with giving free money to the poor for the sole reason they are poor that’s socialism and its wrong everyone has the opportunity to get out of poverty and free money from the government is not a way to get out of poverty just ask people who are on welfare

thanks for giving us our money back. This is coming out of our own paychecks

Who’s More Likely to Be Audited: A Person Making $20,000 — or $400,000?

If you claim the earned income tax credit, whose average recipient makes less than $20,000 a year, you’re more likely to face IRS scrutiny than someone making twenty times as much. How a benefit for the working poor was turned against them.,,.//———

@Hocuz808 saving money is nice but if you aren’t investing and diversifying where/ how your safe money.

@Fen Wan .. I don’t know, I’ve claimed the Earned Income Credit and never been Audited and made just over 20,000 a yr.. In fact, one yr I didn’t think I could claim that.. The IRS a few weeks later after I sent my Taxes in sent me a letter with my Income Tax form and said that they changed it so I did get the Earned Income Credit.. Ohh, and I was never Audited..

Obviously you don’t know what you are talking about..

@Hocuz808 I love watching you poor lap dogs chomping at every chance to change this country into a 3rd world bannana Republic.. ‘ GoOd LuCk ‘!

@Joe Mexican huh?

Bribing the subjects? Cut taxes over all that will raise income for everyone just like we all want. Minimum wage will make more, parents will make more.

No it didn’t, you reality dodging fool.

@Steve Chance , how about making the 1% wealthiest ( you know like Bezos, trump, Walmart etc..) pay their fair share , stop the tax break that trump gave to that same top wealthiest group of people 🤔 then oh.. I don’t know, just maybe the tax cut should go to the middle class and the working poor. Since companies that are owned by the top 1% have employees that STILL have to apply for government assistance . So while their employees work for low pay ( not a livable wage) these companies get away with either paying NO TAXES or pay such a small amount of taxes that those who do the actual work still has to have help. Now does that seem fair to you that ALL tax payers EXCEPT the ones that can AFFORD it the most take up the slack,

@Steve Chance .. It was Kansas..

Now there is someone who doesn’t understand taxes..

@Mr. Liberal weird. Lowest unemployment rates, record breaking stock market, poc being paid more than they ever have .. it’s almost like the pandemic was planned to ruin it all while killing the vulnerable… 🤔

Hopefully this will be enough to help my family out of homelessness that we’ve been recently suffering from. ❤️🙏

@Doc D .. Are you that dumb? Everyone has a cellphone these days.. You don’t know how a smart phone works.. You can get plans for cheap money now.. Pay as you go plans..

Yeeeah, typical Republikkkon beating up on women, children and Parents.. But when the Abortion and Birth Control issues come up you are beating up on them as well.. Nothing but a political football for Republikkkons..

@Doc D um not for my fiance. He has a felony currently and I’m heavily pregnant and can’t currently work. You call yourself a doctor 🤣

@Brenda Odinson So its your fault but others should pay for your poor decisions

@Doc D honestly I blame the pandemic for my family being homeless. I lost my job as a babysitter because I can’t get vaccinated yet, and my fiance lost his after he was arrested. Literally not our fault. And on top of that, we can’t even leave the state to find cheaper housing. The state we are in has a housing crisis leaving almost 20% of people homeless or at risk of homelessness. 🤦

@Brenda Odinson so the pandemic caused your fiance to get a felony?

Free stuff from the Guberment!!!!!

Another handout from Comrade Biden

Go away trolls! Clearly this is just our money to start with. Stop creating fights.

Ok now help out those of us on a fixed income that are struggling…

@Elizabeth Moore disabled, but no problem typing on the computer or riding in a car. Maybe you misspelled lazy?

@Doc D what do you think being disabled is? It comes in all shapes sizes and degrees… Some a very visible… some are invisible… So yes I can type and drive a car… You have no idea what kind of disability I have don’t just amuse…

@Doc D oh god, just because someone can spell and get access to the internet DOES NOT MEAN THAT THEY WILL BE HIRED OVER ANYONE ELSE! ESPECIALLY IF THEY HAVE A DISABILITY! You really need to change your handle because you’re definitely not smart enough to be a doctor

@Elizabeth Moore I’m sorry this person keeps belittling you. Praying for you and your well being🙏 Don’t listen to the uneducated.

@Brenda Odinson thank you much appreciated…

92% of families with kids get it? Why?

because they want to buy votes with everyone else’s money

You don’t get something from nothing, there always a catch we just don’t know it now

Who’s More Likely to Be Audited: A Person Making $20,000 — or $400,000?

If you claim the earned income tax credit, whose average recipient makes less than $20,000 a year, you’re more likely to face IRS scrutiny than someone making twenty times as much. How a benefit for the working poor was turned against them.,,……..

@Fen Wan $20,000 *if* they have the EITC. Hundreds of thousands of people create fraudulent returns and add the EITC in order to get refunds. If you’re honest then you have very little to worry about even if you’re audited. The bigger issue comes when the parents are separated and they both try to claim the kid.

@Fen Wan , why are you copying the exact same thing on everyone’s post? If they are honest in their tax reporting then no worries.

The catch is called Inflation and since Biden won we have had massive inflation on food, gas and most everything else. This is not a coincidence; it’s caused by massive government spending and this new program starting in July and being done every month will lead to more money printing and even more inflation

@888strummer that’s not how inflation works, inflation is a supply and demand thing. witch means you can blame todays inflation on tramps pandemic response !! on the same note, you can blame the government covid relief spending to a point on the lack of pandemic response. just for fun I have a question, how did anybody think a conman that has gone bankrupt 9 times was going to “save” the country???? 🤣

To all the people who think this is awesome it’s not they are pretty much giving us our own money back where do you think they are getting the money? This is a disgusting tactic to stay in power

Who’s More Likely to Be Audited: A Person Making $20,000 — or $400,000?

If you claim the earned income tax credit, whose average recipient makes less than $20,000 a year, you’re more likely to face IRS scrutiny than someone making twenty times as much. How a benefit for the working poor was turned against them.…///

LoL.. Ya, you would rather give it to the Corporations, right.. So they can buy back their Stocks..

Just keep piling on to us single Americans (one income households) – the most taxed people in the country because we choose not to have rug rats until the time is right. Give that tax break to people who have two incomes split that rent/mortgage and already have a child tax credit. We’ll just keep eating grilled cheese and PB&J sandwiches ¯_(ツ)_/¯

@Progressive Humanist here comes the virtue signaling, sorry to say, but creating competition for jobs does not help older generations. Maybe to feed the SS ponzi scheme, but that’s dead in a few years.

@Ida Villegas yup

@Ken EXACTLY WHAT I WAS SAYING! 💯

@Doc D tbh the older generations are also gonna be dead in a few years just saying 🤷

@Brenda Odinson oh I see the olders will be dead….ok so who’s gonna foot the Bill,huh…..who? ….cricket time, chirping, chirp chirp😆😆😆

Accept if you owe student loans. Then you will get nothing.

Chinese Communism has taken over America.

Spoiler alert: we’re done

I owed student loans… crazy thing,, I paid them all off… because that is what responsible adults who take ownership of their own lives do… You made the commitment to the loan, you pay it off…

Guess you shouldn’t have applied for, accepted and spent money you couldn’t pay back huh

@Kyle Riel it’s oveous you know nothing about China or communism!!! spoiler alert: do a little research

Yeah you’re imagining it.

The Disneyworld tax credit.

You ever been to DisneyWorld? Don’t think you have. Try a few thousand dollars to get into Disney. Not a July tax credit payout

🐂💩!

Wtf is going on????

I still haven’t gotten my tax return!!!

This will increase my working hours so I can afford to eat on account of getting taxed up the Ying yang.

Tax credit advance, you won’t get as much back next year when you file

we will have every immigrant in the world show up for this hand out . very sad

im single. i already raised kids, why do my taxes have to feed everyone else. if you cant afford kids then dont have any. dont punish us that work for a living.

Here is a wild idea… How about you make some permanent tax cuts which allows ALL citizens to just KEEP more of their money to begin with instead of giving it back… But then all those bureaucrats who our tax $$ go to pay them to collect all the money then turn around and decide who gets it back will have to go out in the real world and get a job that actually benefits society.

this would have been great 30 years ago when as a single father with 3 kids. where as my kids had food 3 times a day everyday, I on the other hand was happy if I could eat 1 meal every other day. and yes my child care bill was greater than my rent!