The NASDAQ is creeping closer to positive territory for 2020 – stocks are up, so why is this a problem? Andrew Ross Sorkin and American Action Forum President Douglas Holtz-Eakin join Stephanie Ruhle to break it down. Aired on 5/6/2020.

» Subscribe to MSNBC:

MSNBC delivers breaking news, in-depth analysis of politics headlines, as well as commentary and informed perspectives. Find video clips and segments from The Rachel Maddow Show, Morning Joe, Meet the Press Daily, The Beat with Ari Melber, Deadline: White House with Nicolle Wallace, Hardball, All In, Last Word, 11th Hour, and more.

Connect with MSNBC Online

Visit msnbc.com:

Subscribe to MSNBC Newsletter:

Find MSNBC on Facebook:

Follow MSNBC on Twitter:

Follow MSNBC on Instagram:

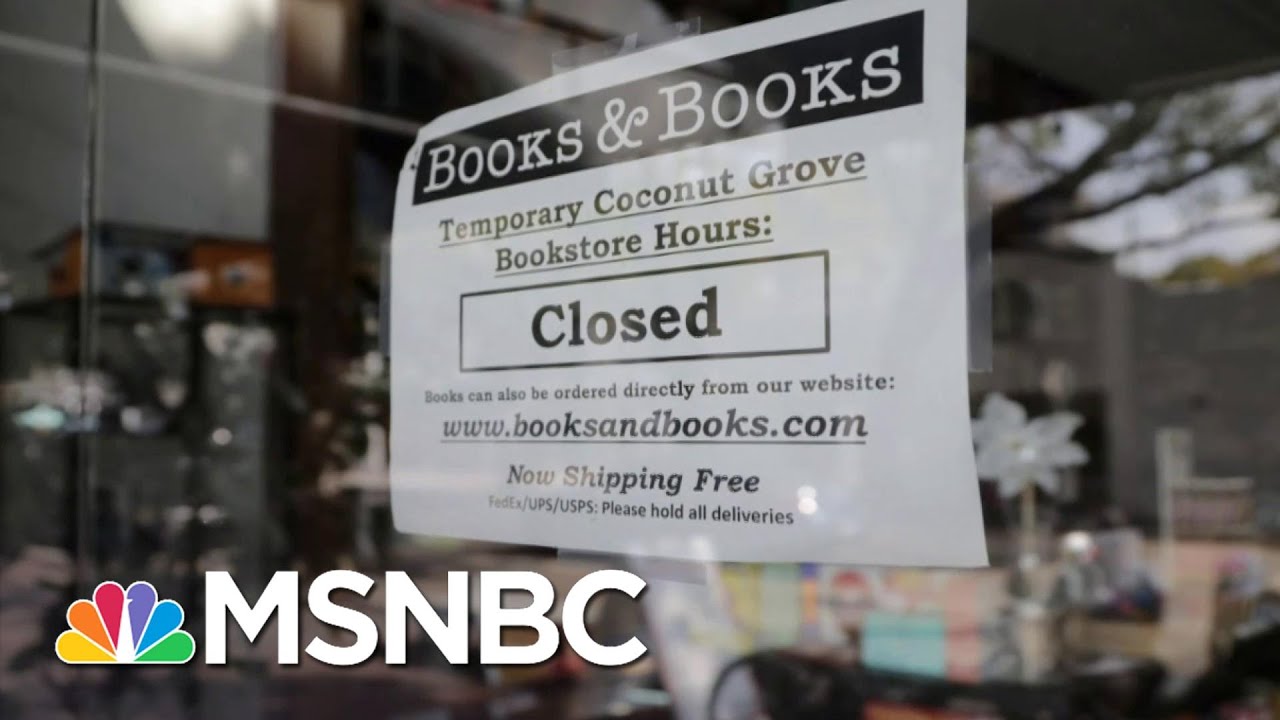

Making Sense Of Stock Market Gains As 30M Americans Lose Their Jobs | Stephanie Ruhle | MSNBC

*Yeah, because trump and the republicants gave the Stock Market 2 trillion dollars, this while people are STARVING !! This shows how bad these Republicans and trump really are!! This is disgusting!! Get rid of them all in November!*

@Mastodon1976 There is nothing wrong with stock buybacks, it’s one of the smartest things a company can do with excess money at the end of the year. If you want companies to hoard cash you’ll have to do away with business taxes.

@Chris Gilliam Man Stuff :If they’re heavily in debt then they shouldn’t be using excess money to buy back their own stock. There were reasons why people warning about corporate debt as far back as the Summer of 18. Why do think the Fed was warning about it last year.

@Mastodon1976 I’m not sure exactly which companies you were talking about but the companies I own that did share Buybacks last year did it with their profits. Keep in mind that although we knew a pandemic was only a matter of time, is still caught us off-guard. Businesses don’t normally plan for a pandemic like this.

@Chris Gilliam Man Stuff umm paying down debt or saving cash on your balance sheet in case of oh say and unexpected event…would have been the smarter thing for companies to do. By the way, companies only pay taxes on the cash they take in once so keeping some on their balance sheet would not subject them to additional taxes. Feel free to go play with your boy bits and leave the discussion to adults until you learn a little more.

@kilgoring troutless Stfu dude. Stock buybacks are one method of lowering debt, in some situations. Stop pretending to know stuff.

Open stores are USELESS when people are STARVING !!

🤩🤩🤩🤩🤩

First people need to pay all the bills that have cumulated under the close down , that will take months … dont know how these economist does not know a thing about economy ?

I am not economist , i am electrician and i can count , business is not back in a day , some trades can close and open fast , when you can get all tools of a trade in one van and that van can be on your driveway or garage .

Some restaurant owners walked away on day one , they rented the location and equipment were leased , so why pay for stuff you dont own and cant make money with ?

Oh so all I need in life is a van.

Stock market is a toy for the one percent. It has nothing to do with the real economy anymore.

Wall Street: Yay!

Main Street: We’re dying.

Wall Street: Shut up.

Main Street 💀

Every salon in America should open today and put hero Shelly Luther’s name in the front window

https://www.zerohedge.com/health/thousands-donate-gofundme-jailed-salon-owner-who-stood-judge-viral-video

@Robert The Bruce Zerohedge = conspiracy site based in Bulgaria. Cool. Your links just keep getting dumber! 😄😅😂🤣

https://mediabiasfactcheck.com/zero-hedge/

@Ro G https://dfw.cbslocal.com/2020/05/06/texas-attorney-general-ken-paxton-immediate-release-jailed-dallas-salon-owner-shelley-luther/

@Robert The Bruce Wow, you posted a link from zerohedge?????? You a flat Earther too??

@Ro G https://www.nbcdfw.com/news/coronavirus/ag-paxton-gov-abbott-call-for-release-of-dallas-salon-owner/2364608/

When the Fed is pumping 3 trillion into the markets, they’re going to go up.

the markets are still going up because its a habit. and because the computer algorithms the morons use really dont even consider the actual value of a company.

as the market crashes, theyre overwhelmed with opportunities their algorithms identify. all signals point to yes.

theres nothing in their algorithms about crippling unemployment and massive reduction in consumer demand. all these idiots know is that all kinds of their favorite stocks are at one-year lows right now and that they have to buy em because… if history is any lesson… theyll be right back up where they were in no time. and thats why the market is up.

Propping up billionaires’ & millionaires’ stock portfolios with public treasure during a plague is the sort of thing that justifies building guillotines.

@Flashy Paws These people don’t have anywhere else to go with their money. It’s a pyramid scheme. As long as some sucker, or the government, keeps putting money in there is some reason to keep playing.

The Fed doesn’t buy stocks.

But I’m buying. There is nowhere else to put money, and in a year there will be a vaccine.

@Chris Gilliam Man Stuff :LOL.The Fed is going in the Bond market among other things.

They’re buying stock in casket manufacturing.

Hmm.

🤔

when are people going to learn that the stock market is not a good measurement of the health of the economy

Yang tried to tell the Democratic party.

Its usually is a good measurement. That’s why people can’t understand It. Also the tech and healthcare sectors are carrying the market right now. Most things are down but money has been flowing out of the losers and into the few winners. People aren’t going to pull their money out and sit on cash like buffet. For the next 6-12 months they’re going to invest into the right places. There’s short term money to be made.

Imagine if that $3 trillion dollar bailout to big corporations actually went to the people. That money would go directly back into the economy, maintaining if not creating more jobs. Also, people would not be so crazy to break quarantines and ushering in a unbridled resurgence of the virus.

how is that supposed to help the 1% craig? Stop thinking about the 99% of us you pleb

Craig Crawford, actually $3 trillion divided by the US workforce (as of August 2019) of 157 million works out to more than $19,000 per worker. That includes part timers, college students, high school kids, etc… it would help a lot more than the $1,200 one time check.

Why do you hate businesses just because they are big?

@Craig Savarese he said EVERY man, woman and child NOT just workers

@ Keith Willis, yes, but that is not how the government is handling the payouts. Only to people with Social Security numbers, filed tax returns, or some form of federal support (Eg SSI recipients). If there are 2, 3 or more workers in your household – a $19,000 payment each would greatly help out the crisis that is driving millions of families to extreme hardship now. As the vast majority of American families are not “financially rich” but live a paycheck or two away from bankruptcy/massive debt, they would be directly pumping those funds back into the economy. The youth would probably do it even faster – fly to the beach, buy consumer goods they couldn’t before, or maybe even just help out their family. That was my point.

It’s really simple . 2 trillion dollars of the bail out money was given to big companies …and what they can only do is to buy up stocks , hence the big jump . Making money in this global crises . So this jump is NOT REAL , but stimulus money used to buy up stocks and not to keep workers from furlough ….this is big mistake .

Effscott Fitz-gee well if u say so . But I do have doubts that the CEO’s of the BigCo will always find a way around this . Did u know that the stock markets in Asia that follows closely the Dow , jumped a huge spike hours before NYSE even rang the bell for the day . Go figure

James Syddall , I’m an investment banker, so I am always aware of movements in international markets. However, I’m not sure what you’re insinuating. The correlations between various markets, indices, sectors, asset classes, etc generally reflect their revenue sources, capital flow, currency valuations, etc (very loose 30,000 foot overview). In other words, the value of a company in china could possibly go up due to a US bailout of a US company if the Chinese company expects their future revenues to grow as a result of the US company’s ability to purchase goods/services from the Chinese company in the future. If the US company uses the bailout for buybacks, rather than to improve their balance sheet and maintain their cash flow (i.e. the company’s health), the the US company will be in the same insolvent situation they were in prior to the bailout and unable to benefit the Chinese company. So again, I don’t know what your insinuating by pointing out an intraday market movement and trying to correlate it to the DOW.

Effscott Fitz-gee well just say that I have several business and u can Google me James syddall or syddall diamonds . I have a contact section in the link . I am most of all investing diamond and Gold for 25 years .hope yr right but it’s always good to meet someone or get to have a new friend.

James Syddall Very Impressive! Your “Kate” ring is stunning. I imagine natural sapphires are not easy to source now that India has been hit so hard by the virus. Or perhaps Sri Lanka was spared?

I couldn’t agree more. It’s always good to meet new people and make new friends.

One last thought on the markets. My instincts tell me that the markets are somewhat over optimistic at the moment. We don’t yet know how bad the global economy has been damaged by the shutdowns. All central banks are being accommodative, though this isn’t sustainable over a long period of time. There is opportunity in chaos, but a global liquidity crisis could breed desperation, panic, and conflict.

Effscott Fitz-gee yup ,that’s me in the flash . And ur right , nows the time to HOLD as rare sapphires has no reduction in price , I personally love the deep blue sapphires . I work with a lot of investment banker ….believe it or not my best clients in 2008 sept was Lehman brother and I was moving big diamonds with the TOP managements , just after their pay off umbrellas . Best darn month and year for certified diamond. That’s why I said , big bail outs and the money was given to investment Bankers in HK , which were all my mates . Many took the money and pledged it to physical diamonds . I worked with the TOP guys at lehmen and continued to do so when they all moved over to Nomura investment

“There may be a second wave.” Awfully optimistic there, every expert agrees that there WILL be a second wave almost certainly worse than the first in the fall assuming the first wave actually has a chance to die down during summer.

The virus has already mutated from what I seen, and it’s not looking good, really. 2020 is the new 1918…

Even Trump concedes there will be many more deaths. It’s a near certainty at this point.

The stock market has been a fraud for a couple of years now.

“Couple of years”? the stock market has always been rigged.

@Johnny Rad Do you invest or not?

Nixon: lets get tid of the gold standard. Why should a country have to pay its debt . Bush: lets bail out the banks. Why should finance sectors have to pay its debt. Trump: lets bail out every company. Why should companies have to pay down their debt. Why- because the american people have to pay the bill.

@Ellen Gran Problem is, the American people are not paying the bill. Government and personal debt verify this. Btw, gold is just another arbitrary standard.

@Ellen Gran why do you have a problem with bailouts? Do you not realize that the American taxpayer lost nothing under TARP? Every cent was repaid.

5:47 Once again, socialism for the rich; capitalism for the poor.

Socialize the risk, privatize the reward. Its the American way! smh

Read The New Class by Milovan Djilas c1957, former vice president of communist Yugoslavia…

Communism is capitalism for the rich!

You got that backwards. Rich people are getting nothing, businesses are getting loans, and people are getting handouts.

It’s a Depression not a Recession. People are in “bread lines” businesses are closing and going bankrupt while people are dying. People don’t have $$$ to buy anything. Retail and travel have collapsed. I don’t get the market’s optimism when you don’t even have a real President.

*”la mulata linda Martinez:”* Well analysed and so spot on.

People who 😳 at the stock market charts are thinking, oh, ‘stocks up, recovery up, job done; let’s go party.’

Forget about those poor plebs, “let them eat cake” – forget about job losses; forget about losing homes, businesses, life savings; forget about the misery added triple-fold on *top of that* with families losing members through deaths, by the 10’s thousands and *will go HIGHER* for sure over coming months.

Because the people in the market are just looking for personal opportunity in risk. Big risk, big opportunity. It’s not about the “economy”. that’s just b.s. media talking to people who still think the market is the economy. It’s not, and hasn’t been for decades. The game has been refined to operate regardless of what the economy is doing. The investors are only optimistic about their ability to find a big payment. They don’t care about anything but the payoff. It is totally outside of the real world issues. The second they believe the opportunity is ending, they will bail out. Many have hedged bets that the market will crash. They know it eventually will. They make money either way, and the “economy” is just a derivative issue.

@C J YEP!

I am not buying any new clothes for next two years…

You might want to review the French revolution. Just like the virus was a tipping point financially. Hunger and loss will be another tipping point.

Turn the Feds printer off and watch the market fall 70%.

“Wait, thousands of Americans are dying and millions are unemployed? Let’s give trillions of dollars to corporations for share buy-backs so the rich get richer.”

It’s time to invest in crypto

How can I reach this woman

Yes, how is she contacted

+1(856) 223 2289

Message her on watsapp 👆

If you’ve started trading with her you’re not far from making profit

it’s simple. Those gains can only be temporary. People are taking their last bits of money and dumping it into the system in order to purchase things that they need. When that money dries up, stock market losses are sure to follow.

Stock market is a toy for the one percent. What Rich criminals do has no relationship to the real economy anymore.

A quick investing tip: try Dollar Cost Averaging (DCA)! Just invest a little bit of money each week no matter what the market does. Then, if it rises, you can take advantage of the upswing. If it drops, you can take advantage of the downside with your weekly amount!