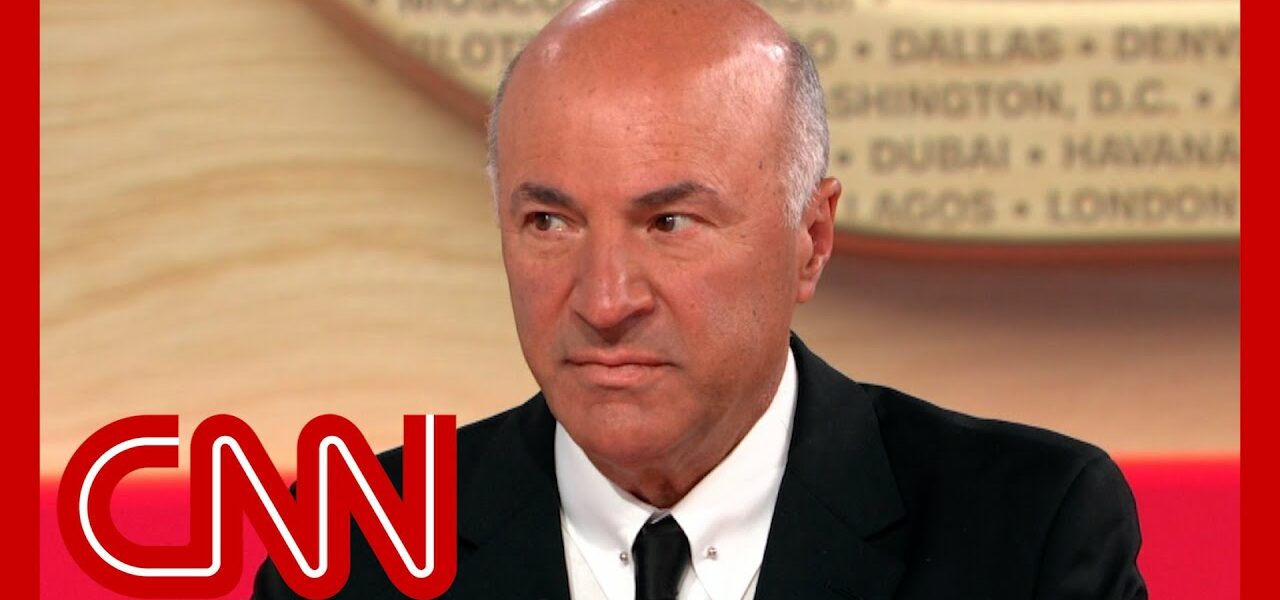

Kevin O'Leary, chairman of O'Leary Ventures and host on "Shark Tank," reacts to the Senate hearing on the collapse of Silicon Valley Bank. #CNN #News

‘Shark Tank’ star reacts to Senate hearing on bank failures

Kevin O'Leary, chairman of O'Leary Ventures and host on "Shark Tank," reacts to the Senate hearing on the collapse of Silicon Valley Bank. #CNN #News

No one is saying what really happened : They stole customer’s money. PERIOD.

They didn’t steal customer money. But they defrauded shareholders. They owe loyalty to the shareholders. When I am a CEO and I sell $300 shares to you knowing they will be worthless in the near future. I’m trading on inside information and I’m betraying you as a shareholder. I’m working against you rather than for you. They owe fidelity to their shareholders. The senior executives need jail sentences.

Provide EVIDENCE for your BS theory

@dave mitchell Oh really? And how exactly does one cover their tracks here? You really aren’t too bright, are you?

@Lunatic Fringe your not very bright there are endless ways to launder money.

How many millions did the bank managers /executive make? They should be fined and jailed.

Well if they did wrong then FDIC will go after them, because FDIC is the insurance company here, and if they defrauded the FDIC insurance company then I’m sure they will be found out and charged with fraud crimes as a result. This is between the banks and their insurance company (FDIC) we have nothing to do with it, and the US Government has nothing to do with it either, all the government does is force them to have the insurance.

It’s funny how “Corporations are people” until they commit crimes.

Just like in 2008, right?

Oh really? They should be fined and jailed? For what? Not correctly anticipating public stupidity?

Yes, I do agree that they royally screwed the pooch, but it sure as sh*t isn’t what you say. I bet their stress testing had them making $$ when interest rates rise.

“To big to fail” sure does fail a lot…

But SVB, Silicon and Silvergate all failed. What on God’s green earth are you talking about?

@Lunatic Fringe bruh… reread the statement

@Trial by Wombat You don’t even know what this topic is about do you?

@DarthSailorMoon I sure do. Thank you for your comment 😊

That trooper, Chris Hollingsworth, was widely seen as the most culpable of the half-dozen officers involved, but he died in a high-speed, single-vehicle crash in 2020 just hours after he was informed he would be fired over his role in Greene’s arrest.

Bank failures in any country are possible

I really don’t expect a millionaire to relate to the middle class and how they handle their finances.

@Georgie Are you five? Or perhaps from Florida?

But I bet you vote for the same millionaire politicians time and time again

Someone has to be held accountable. They can’t walk with millions of dollars and then have us bail them out. Time and time again.

@Billy SBC yes they got nailed out that’s why they are still around

@Billy SBC Ha, EXACTLY! I was saying the same thing. Kevin is F-ing clueless here

@Lunatic Fringe Yes, this comes straight from the FDIC website…

“The FDIC receives no Congressional appropriations – it is funded by premiums that banks and savings associations pay for deposit insurance coverage. The FDIC insures trillions of dollars of deposits in U.S. banks and thrifts – deposits in virtually every bank and savings association in the country.”

Small businesses need regional banks

Here’s the issue, when banks fail, doesn’t matter from what bank. Small banks still have 100s, maybe 1000s of people that use them. If people use a small bank that fails and they lose money that’s not backed by the government, people lose confidence in the banking system in the US. This can cause a ripple effect causing people to pull their money out of their banks causing more bank failures.

My nephew was able to get a mortgage through the local bank because they knew him to be a person of integrity. To big banks he’s just another number.

@Dark Forest Not necessarily. I think they should be responsible for their decisions but they do have a valid place in our country.

Your nephew was able to get a mortgage because of his FICO score – not because of a personal relationship – that “type” of bank loan ended in the ’90s.

@Jill S He didn’t have a credit score. He had been paying rent on time for 5 years on time. ;landlord was a bank employee

I use to teach financial classes to families who were going to receive a Habitat for Humanity house. When the local banks came in to make presentations, their #1 focus was building their savings. On one hand I understood. People needed to save for emergencies. After awhile I came to the conclusion that savings were more for the banks than the families. Finally, I have a question. What does the downfall of SVB mean for Credit Unions? Is it the same problem?

I doubt it as credit unions have different internal goals. I won’t say it *couldn’t* happen, as this was a case of serious and basic mis-management over more than a year. It shouldn’t happen that way at larger banks because they have monitoring on them. Banks in this mid-range lobbied to be relieved of that monitoring.

So hold these people accountable (especially to those people who gave themselves bonuses and who also pulled out their $$ before the fall) and don’t keep all your eggs in one basket.

Most people only have one egg

@Raymond Anderson Correct, thank goodness for FDIC insurance up to $250,000. so far….

Oh, what bonuses are you talking about exactly?

Kevin O’Leary, how to get away with negligent homicide.

thats exactly what he and his wife got away with…

@Lor White I disagree. If you are operating a boat in the Muskokas and you decide to turn off ALL your boat lights at night so you can star-gaze in pitch dark, then you run the risk of being hit by another boat. Canada’s RCMP tried & tried to show that the O’Leary boat *must* have been speeding to hit the darkened boat — but *their own RCMP* tests proved the opposite. Area surveillance also proved that the O’Leary boat could not have seen the darkened boat *even at the legal speed.* The doctor whose unlit boat got hit sued O’Leary because the doctor’s insurance was affected by his folly in turning off all the lights. And no, I don’t even remotely like O’Leary. But fair is fair.

@Cathryn Campbell money talks, Muskoka money walks…

He’s arguing that we should get rid of competition for big banks, so that people like him can keep getting richer!!

@MannyG – Yeah, because he didn’t explicitly say “we should get rid of competition for big banks”, rite?

Yup. He’s mischaracterizing everything as a credit card and that’s it. He’s also overly aggressive when any retort is given.

The “big banks” he’s talking about have crappy rates and even crappier customer service.

@Kuckoo no. He saying if you want em in your town fine..but you pay for them not other taxpayers in another part of the country. His argument is if they’re not run by competent people and prone to fail why should taxpayers pony up the bailout.

Should’ve asked him if he feels the same way about his Boy SBF if you know then you know 😂😂

…and CNN is onboard with that.

I would trust this man as much as he respects me for having a normal Job.

Kevin is absolutely correct in what he said!! And now to Kevin….I’ll gladly take one of your watches, lol😊

Seems like a tactic to eliminate all local regional banks and only leave the near monopolies, too-big-to-fail huge banks, which would make them so much more powerful than they already are, and which also get bailed out.

Same thing that Corporations like HomeDepot, Duane Reeds, et-al have done with neighborhood hardware stores, pharmacies, restaurants, and on and on.

The point @cnn failed to make was one Kaitlin almost touched on. There are a lot of luddites and elderly people who either can’t or won’t bank online because it’s too difficult for them or they mistrust big national banks. I think if you asked Kevin’s question in an honest way, making sure people understand the pros and cons of “do you want to pay to bail out regional players,” that you’d get a very different answer from what he expects.

Rich guy out of touch with normies; big shocker.

Kevin O’Leary (no doubt deliberately) does not mention that he is a Canadian and in Canada the rules around banking are far stricter. We have far fewer banks which are all large and strong. We also have credit Unions all of which are protected to $250k by deposit insurance. No doubt Kevin hates them, too.

I trust this guy’s economic advice as much as his wife’s boating advice.

Great segment. Kaitlan and Don were stellar.