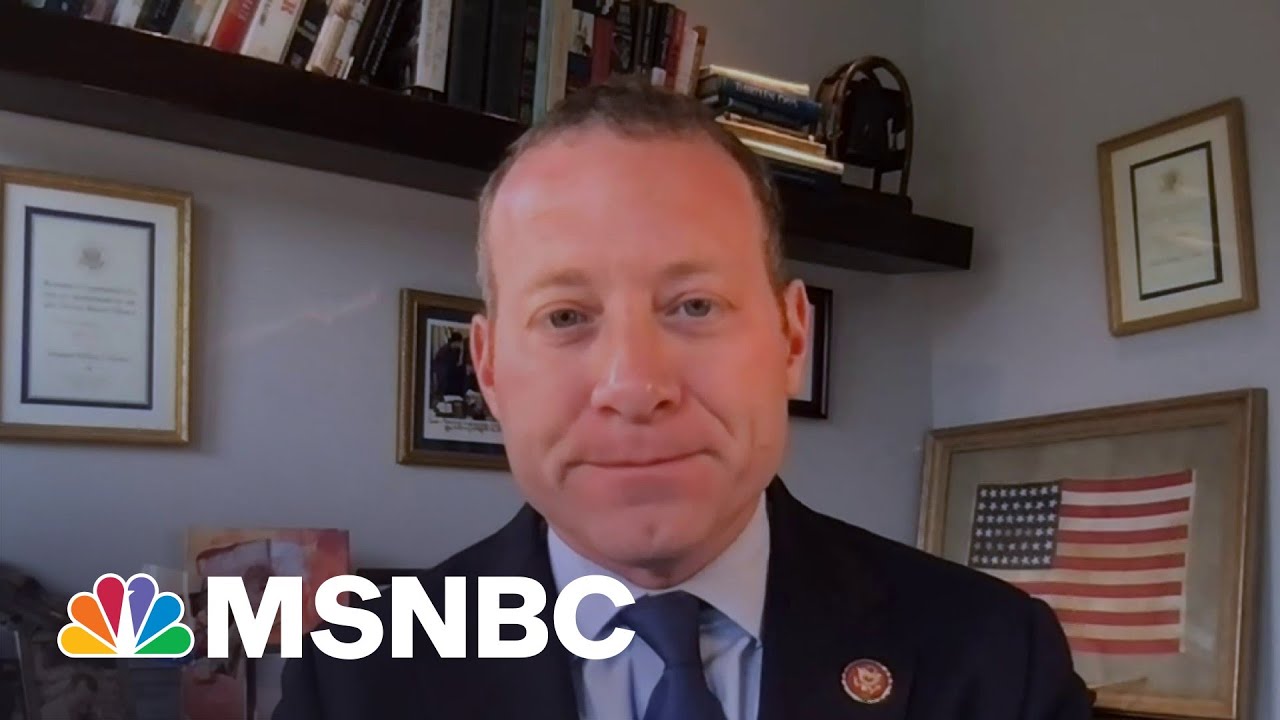

As President Biden makes a bipartisan push to sell his infrastructure plan, Reps. Josh Gottheimer (D-NJ) and Tom Suozzi (D-NY) tell Stephanie Ruhle that addressing the SALT deduction cap is make or break for them despite Democrats' razor thin majorities in Congress. "No SALT, no deal," the SALT Caucus Co-Chairs say.

» Subscribe to MSNBC:

About: MSNBC is the premier destination for in-depth analysis of daily headlines, insightful political commentary and informed perspectives. Reaching more than 95 million households worldwide, MSNBC offers a full schedule of live news coverage, political opinions and award-winning documentary programming — 24 hours a day, 7 days a week.

Connect with MSNBC Online

Visit msnbc.com:

Subscribe to MSNBC Newsletter: MSNBC.com/NewslettersYouTube

Find MSNBC on Facebook:

Follow MSNBC on Twitter:

Follow MSNBC on Instagram:

Democratic Reps. On Biden Infrastructure Package: 'No SALT, No Deal' | Stephanie Ruhle | MSNBC

Unlike the Repubs who passed the 2017 tax cuts that ended the SALT, Dems are actually working to help middle income earners.

How? By packing infrastructure bills with trillions in pork?

Lol. 57% of the benefits of repealing the SALT cap goes to the top 1%

@MrVedude That’s better than 90% of the Republican’s cuts going there. I live in MN. We have a fairly high tax rate. I’d like to be able to deduct those state taxes from my federal obligation.

@T.A. ACKERMAN

That doesn’t make any sense. Why should we have any tax provisions that are regressive? I didn’t like the Trump tax cuts because they were regressive, but I also don’t want to repeal the SALT cap because that’s also regressive. Let’s instead have a modest UBI

@MrVedude How is it regressive? In MN we have a progressive tax policy. The amount I’ll be able to deduct from my federal tax will be based on that same progressive tax. Not being able to deduct it makes moving to states with no state income taxes (aka red states, that’s why it’s in the law) more attractive for homeowners. They are the ones who benefited from doing away with the SALT deductions.

I love Stephanie.

Why don’t you marry her then?

I’m glad they’re pushing for middle and lower class protections. We can’t let the rich turn “tax the rich” into “tax everyone” into “tax everyone EXCEPT the rich”

It’s just going to make them more poor

They’re not pushing. They’re posing. All talk and zero action

We need to eliminate the abuses of trickle down economics. Restore write-offs for middle class and low income. Tax the rich. Add dental health benefits to ACA.

One rich person already pays moe in taxes in a year than you’ll pay in your life. Wise up.

@Tom Grunhard And one rich person makes more money than they’ll ever need in their life.

Stop simping.

@Tom Grunhard You ‘wise up’. The rich don’t pay a dime in taxes they can’t pull right back through the loophole, even while accepting subsidies! Rich, indeed. Save it.

FFFF the ACA. We need Medicare 4 All. I would have thought this pandemic would have convinced people that ACA (read: Romneycare) is a half measure that won’t cut it.

My taxes went up as well with Trump’s giveaway to the rich. He punished blue states like mine.

He’s telling you how he proposes to pay for it. If they’d stop fear-mongering and work on another solution for paying for the plan then voters could take them seriously.

It’s going to cost much more in the long term if we don’t pay now.

No pepper, no eels.

Yes, they need to eliminate all these tax the middle class issues that trump installed!!

The only thing trickling down is taxes.

Why salt?

Oh I know why.

Tax billionaires out of existence.

Noone should have the buying power of small countries. It’s a world-wide danger. How long before they come to the idea to make their own military forces (I’m pretty sure they already have.)

@Aaron Okeanos Exactly

Big business escaping, evading paying their fair share of taxes has been going on too long, because workers, public servants or tradespeople don’t have loopholes and taxes pay for schools, hospitals, roads, parks etc etc Trickle di trickle da trickery done effect doesn’t work.

Would things change if working class taxpayers decide to not pay our taxes? Why are WE the only ones carrying this country?

Do you have a company? Do you earn more than 400,000$ per year?

If not than there will be no changes for you.

That would’ve been a good idea in the 60’s or 70’s before everybody had their families wealth siphoned away and handed over to illegal aliens, it’s too late for that now.

I like salt and pepper on my eggs. Ketchup too

Lol. Most people with money have properties in high tax states and low tax states. It’s a wash for me as I spend part of my time in both areas of the US.

With a LOT of accountability for our tax dollars. Please.

Oh yes the SALT, think about the rich. C’mon guys haven’t they suffer enough? They won’t be able to get third pool this year sigh…. Yes working class support you.

NO F#%$off, keep the SALT.

nice… new jersey… whatever… live in seattle… one of the highest taxed state in the union… try to make it on 15 bucks an hour here….

solution: FLAT TAX… 10%… NO DEDUCTIONS…. buisness pays 15% flat tax… no deductions. Ever notice the poorest states are red states?

I believe there should be a greed law.

Sure, you can do whatever you want with your company-

However…

Carrot vs Stick needs transparency and consequences that are an actual penalty.

These issues effect us directly.

Those ridiculous incentive bonuses🤦🏻♀️- corporate greed- costs taxpayers on multiple levels.